Bergen County Fee-Only Certified Financial Advisor Providing Customized Investment & Retirement Solutions

Bergen County Fee-Only Certified Financial Advisor Providing Customized Investment & Retirement Solutions

Retirement Planning and Investing Expertise

As a fee-only financial planner and fiduciary, Wharton Wealth Planning is obligated always to put client interests first. Our fee-only approach helps create the greatest amount of objectivity in our recommendations, and we do not accept commissions or other compensation from financial product companies.

We assist individuals and families in Englewood Cliffs, Tenafly, Alpine, and surrounding Bergen County, New Jersey, with over 25 years of experience in professional finance. We serve clients with their retirement planning, investment management, tax mitigation, and cash-flow needs to help protect and grow their assets. Each service is tailored to meet our clients' unique needs, from crafting personalized investment portfolios to navigating complex financial landscapes and ensuring tax efficiency.

Financial plans and asset management strategies are developed by a dual-credentialed CERTIFIED FINANCIAL PLANNER™ (CFP®) with an MBA. We can help make life transitions less time-consuming by monitoring your accounts for opportunities and solutions that align with your long-term financial goals.

Our financial planning and investment management processes focus on long-term tax minimization. We evaluate potential tax consequences in all areas of financial planning to uncover opportunities to reduce your taxes.

Our financial advisor team can help you assess the degree to which you are ‘on track’ for a future or current retirement. We use sophisticated analytical techniques to develop a cash flow and investment strategy designed to maximize the chances that our clients will succeed at achieving their goals.

How Can a Fee-Only CFP® Financial Advisor Save You Money?

If you want an ongoing and continuous relationship, a fee-only investment management relationship may be the best option.

We focus on using tax-efficient ETFs and mutual funds to create low-cost, diversified portfolios in line with your investment objectives and, in our view, financial well-being. Fee-only financial planning means we are compensated solely by the fees you pay for our advice and services. This model promotes trust, transparency, trust, and a fiduciary commitment to your financial future.

A good fee-only advisor will review your existing investment accounts – including your IRAs, retirement plans, and brokerage accounts – and search for ways to reduce costs, fund management fees and expense ratios, and transaction costs on your existing investments. In many cases, an advisor can find thousands of dollars in high-fee funds and excessive capital gains and distribution taxes that can be reduced by over 50% by substituting and replacing your existing mutual fund investments.

At the heart of our investment philosophy is a focus on preserving your capital while pursuing sustainable, long-term growth. We avoid speculative market timing and instead concentrate on sound, disciplined strategies that aim to protect and grow your wealth through all market cycles.

In addition, a fee-only advisor can help you evaluate a range of insurance options (such as term life or whole life insurance, long-term care insurance, disability insurance, malpractice insurance, umbrella insurance, etc.) that you may wish to purchase and need unbiased advice on. This can add value for a client and bring a new perspective to your decision-making process.

Investment Management Oversight

Tax Efficiency - We believe controlling tax liabilities is one of the most certain ways to improve returns.

Tax Efficiency - We believe controlling tax liabilities is one of the most certain ways to improve returns. Cost Efficiency - We assess and select lower-cost investment managers and custodians so we can pass those savings directly along to you.

Cost Efficiency - We assess and select lower-cost investment managers and custodians so we can pass those savings directly along to you. Targeted performance – We construct customized portfolios that have a high probability of success over time to help you meet your goals.

Targeted performance – We construct customized portfolios that have a high probability of success over time to help you meet your goals. Risk Management - Our tested and structured framework can help identify gaps between your preferred level of risk and your actual risk.

Risk Management - Our tested and structured framework can help identify gaps between your preferred level of risk and your actual risk. Asset Allocation and Diversification - We seek to minimize risk and maximize return by constructing portfolios comprised of investments with fundamentally unrelated risk factors. We seek to minimize the damage that may be caused by investing emotionally.

Asset Allocation and Diversification - We seek to minimize risk and maximize return by constructing portfolios comprised of investments with fundamentally unrelated risk factors. We seek to minimize the damage that may be caused by investing emotionally. Lifetime income stream creation- We use a balanced approach to invest for both safety (income) and growth.

Lifetime income stream creation- We use a balanced approach to invest for both safety (income) and growth. Monitor and adjust portfolios – We rebalance portfolios to maintain appropriate asset allocation and take advantage of market conditions and opportunities.

Monitor and adjust portfolios – We rebalance portfolios to maintain appropriate asset allocation and take advantage of market conditions and opportunities. Track market and investment performance relative to return targets and client objectives.

Track market and investment performance relative to return targets and client objectives. Report performance and deliver progress updates.

Report performance and deliver progress updates. Assist with wealth strategies for legacy investment planning.

Assist with wealth strategies for legacy investment planning.

Questions we might ask a prospective client:

- Please rank your primary financial concerns in order.

- Tell us more about how you arrived at your current asset allocation. Do you own stocks, bonds, mutual funds, and/ or ETFs?

- What is your desired annual rate of return on your investments?

- What types of retirement accounts are you currently utilizing?

- Is your overall main focus to increase returns, increase returns while also reducing risk (potential investment losses), or reduce risk (potential investment losses)?

- What is your planned time horizon for investing?

- What tax planning opportunities have you taken advantage of?

- Have you considered Roth conversions or using Roth retirement accounts?

- What are your plans for filing for Social Security benefits?

- When was the last time you updated your estate documents?

- Is leaving money to your heirs at the end of life important to you? If so, tell us more about this goal.

- How have you structured your retirement account beneficiaries?

- You have a large, concentrated position in XYZ stock – what are your plans for this security, managing the risk, and navigating the taxes?

- Do you have long-term care insurance? How did you arrive at that decision?

How Our Process Works

Our expertise in personal finance helps ensure that your money and the various components of your financial plan work together as efficiently as possible in an ongoing relationship.

We begin the process by asking about your current financial situation and your financial goals. Using this information, we assess your circumstances and develop an action plan designed to address any flaws in your existing strategy or establish a more robust financial strategy.

In our analysis, we consider your investments, savings rate, spending needs, potential income, taxes, and inflation. We then perform stress tests on different “what if” scenarios and simulated market conditions to develop a plan designed to maximize your spendable retirement income and extend the life of your portfolio.

Once we gain a comprehensive understanding of your financial profile and goals, we provide recommendations and outline steps to help you achieve your objectives. We will create customized investment portfolios that emphasize long-term principles. We diversify, implement low-cost strategies, and proactively rebalance to achieve optimal risk management and client satisfaction.

We periodically review the plan and, as needed, make revisions to reflect changes in personal and economic conditions.

Get in Touch With Us to Discuss Your Questions and See If We May Be a Good Fit for Your Needs

Please let us know what specific areas you would like help with. There is no charge for an initial meeting. During the introductory meeting, we will discuss your current financial situation, future goals, and concerns. We will also answer your questions and introduce you to Wharton Wealth Planning’s services.

We look forward to meeting you.

-

Or Give Us a Call at 646 450-7021

Book an Introductory Call

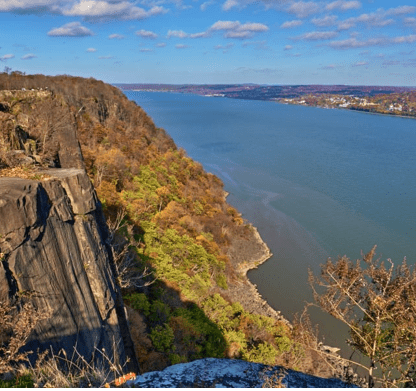

Financial Planner Englewood Cliffs | Bergen County, New Jersey

Our office is conveniently located in northern Bergen County, New Jersey just north of Manhattan near the George Washington Bridge, off the Palisades Parkway, close to Route 4, I-95 and Route 46. Our office is easily accessible from Fort Lee, Englewood Cliffs, Tenafly, Hackensack, Teaneck, Alpine, and surrounding areas of New Jersey.